Condo Insurance in and around Salem

Welcome, condo unitowners of Salem

Insure your condo with State Farm today

Calling All Condo Unitowners!

When it's time to catch your breath, the retreat that comes to mind for you and your favorite peopleis your condo.

Welcome, condo unitowners of Salem

Insure your condo with State Farm today

Put Those Worries To Rest

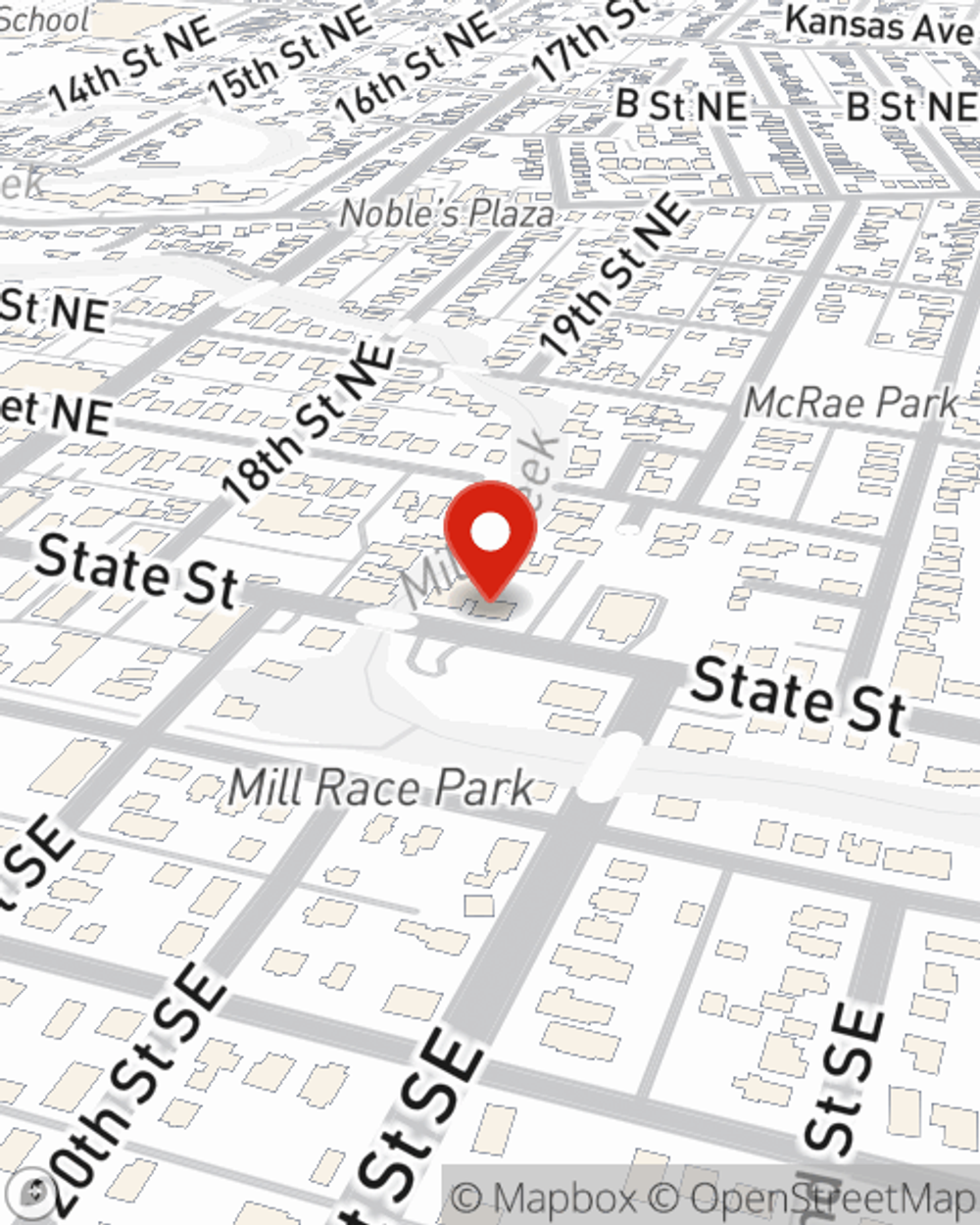

That’s why you need State Farm Condo Unitowners Insurance. Agent Ted Ferry can roll out the welcome mat to help create a policy for your particular situation. You’ll feel right at home with Agent Ted Ferry, with a no-nonsense experience to get dependable coverage for your condo unitowners insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Agent Ted Ferry can help you file your claim whenever the unexpected happens. Home can be a sweet place to be with State Farm Condominium Unitowners Insurance.

When your Salem, OR, condo is insured by State Farm, even if life doesn't go right, State Farm can help protect your property! Call or go online today and find out how State Farm agent Ted Ferry can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Ted at (503) 370-7716 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.